nd sales tax exemption form

The purchaser must complete all fields on the exemption certificate and provided the fully completed certificate to the seller in order to claim exemption. North Dakota sales tax is comprised of 2 parts.

Printable North Dakota Sales Tax Exemption Certificates

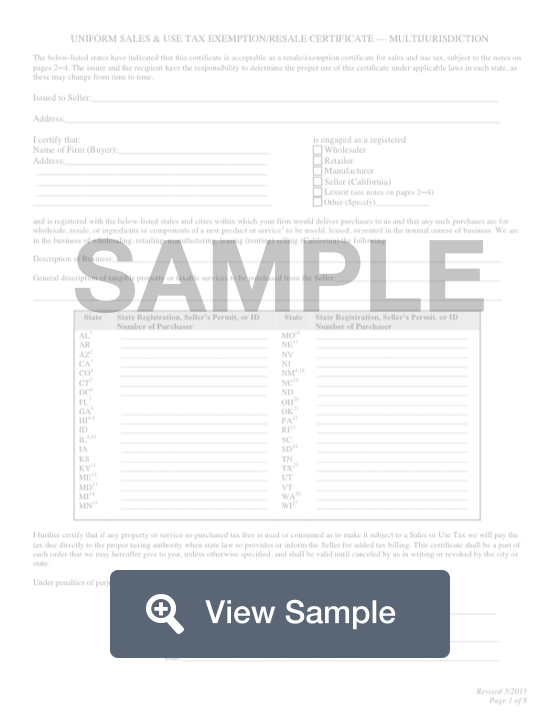

Not all states allow all exemptions listed on this form.

. Form DR-501M Deployed Military Exemption Application. Streamlined Sales and Use Tax Agreement Certificate of Exemption. Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets.

The sales tax is paid by the purchaser and collected by the seller. This is a multi-state form. Depending on when a property was transferred new owners should contact the title company handling the closing of the property or review their closing statement to determine who is responsible for.

For more information and detailed instructions see Tax Information Publication number 10A01-07 issued on June 22 2010. Gross receipts tax is applied to sales of. Form F000 231 - Wisconsin Revisions effective anuary 1 201-3-Use this form to claim exemption form sales tax on purchases of otherwise taxable items.

December Property tax statements are mailed during the first week to all property owners of record as of November 1st. Will be subject to use tax and the applicable discretionary sales surtax however effective July 1 2010 the maximum tax on the use of a boat or vessel is 18000 including sales tax and discretionary sales surtax. North Dakota imposes a sales tax on retail sales.

A servicemember who receives a homestead exemption may receive an additional ad valorem tax exemption on that homestead property if heshe was deployed during the preceding calendar year on active duty outside the continental United States Alaska or Hawaii in support of designated. The seller may be required to provide this exemption. North Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Tax Cycle Calendar Important Dates to Remember.

North Carolinas maximum marginal income tax rate is the 1st highest in the United States ranking directly below North Carolinas.

Rental Verification Form Real Estate Forms Real Estate Forms Certificate Templates Word Template

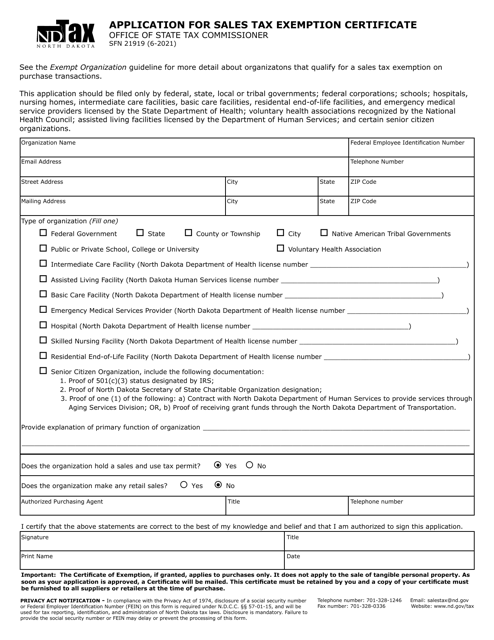

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

Form 21919 Application For Sales Tax Exemption Certificate

Business Leaders Think These Are The Best States For Education Business Leader Education Historical Maps

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller